Money & Economics

- Thread starter bigredfish

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Even Funnier!

January Jobs Shocker: Payrolls Explode By 353K, Double The Expected And Higher Than All Estimate As Wages Surge

January Jobs Shocker: Payrolls Explode By 353K, Double The Expected And Higher Than All Estimate As Wages Surge | ZeroHedge

With Wall Street expecting a continued declines in the pace of monthly growth, and consensus looking for a decline from last month's 219K print to 185K, the BLS decided to once again show logic and common sense who is boss, and damn your mass tech layoff torpedoes...

January Jobs Shocker: Payrolls Explode By 353K, Double The Expected And Higher Than All Estimate As Wages Surge

January Jobs Shocker: Payrolls Explode By 353K, Double The Expected And Higher Than All Estimate As Wages Surge | ZeroHedge

With Wall Street expecting a continued declines in the pace of monthly growth, and consensus looking for a decline from last month's 219K print to 185K, the BLS decided to once again show logic and common sense who is boss, and damn your mass tech layoff torpedoes...

... it reported that in January the US created a ridiculous 353K jobs...Dear @BLS_gov, since you have trouble finding actual data, we've made it easy for you - here are the layoffs announced in the past few months:

1. Twitch: 35% of workforce

2. Hasbro: 20% of workforce

3. Spotify: 17% of workforce

4. Levi's: 15% of workforce

5. Zerox: 15% of…

— zerohedge (@zerohedge) January 31, 2024

Inside The Most Ridiculous Jobs Report In Recent History

Inside The Most Ridiculous Jobs Report In Recent History | ZeroHedge

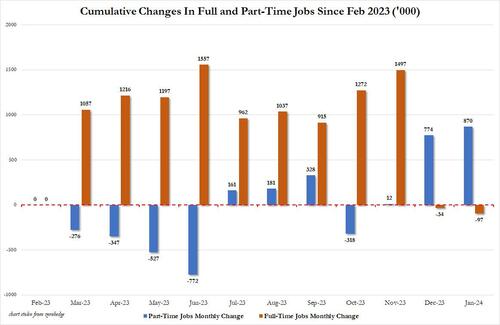

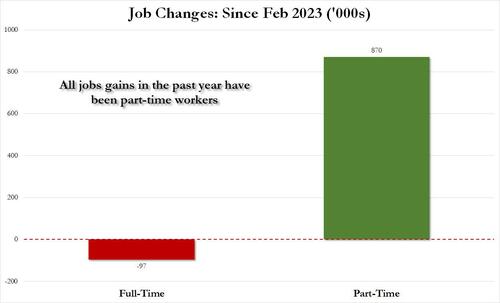

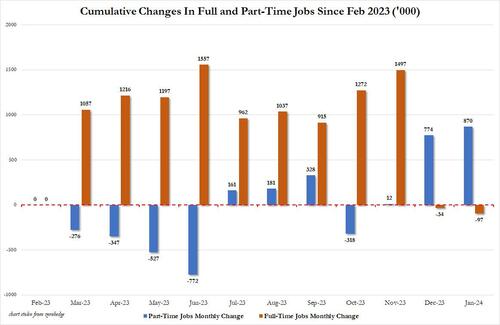

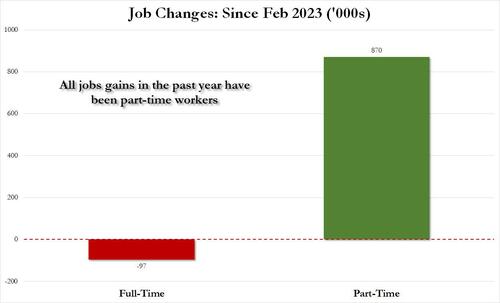

There's more: shifting from a quantitative to a qualitative assessment, reveals just how ugly the composition of "new jobs" has been. Consider this: the BLS reports that in January 2024, the US had 133.1 million full-time jobs and 27.9 million part-time jobs. Well, that's great... until you look back one year and find that in February 2023 the US had 133.2 million full-time jobs, or more than it does one year later! And yes, all the job growth since then has been in part-time jobs, which have increased by 870K since February 2023 (from 27.020 million to 27.890 million).

Here is a summary of the labor composition in the past year: all the jobs have been part-time jobs!

But wait there's even more, because just as we enter the peak of election season and political talking points will be thrown around left and right, especially in the context of the immigration crisis created intentionally by the Biden administration which is hoping to import millions of new Democratic voters (maybe the US can hold the presidential election in Honduras or Guatemala, after all it is their citizens that will be illegally casting the key votes in November), what we find is that in January, the number of native-born worker tumbled again, sliding by a massive 560K to just 129.807 million. Add to this the December data, and we get a near-record 1.9 million plunge in native-born workers in just the past 2 months!

Inside The Most Ridiculous Jobs Report In Recent History | ZeroHedge

There's more: shifting from a quantitative to a qualitative assessment, reveals just how ugly the composition of "new jobs" has been. Consider this: the BLS reports that in January 2024, the US had 133.1 million full-time jobs and 27.9 million part-time jobs. Well, that's great... until you look back one year and find that in February 2023 the US had 133.2 million full-time jobs, or more than it does one year later! And yes, all the job growth since then has been in part-time jobs, which have increased by 870K since February 2023 (from 27.020 million to 27.890 million).

Here is a summary of the labor composition in the past year: all the jobs have been part-time jobs!

But wait there's even more, because just as we enter the peak of election season and political talking points will be thrown around left and right, especially in the context of the immigration crisis created intentionally by the Biden administration which is hoping to import millions of new Democratic voters (maybe the US can hold the presidential election in Honduras or Guatemala, after all it is their citizens that will be illegally casting the key votes in November), what we find is that in January, the number of native-born worker tumbled again, sliding by a massive 560K to just 129.807 million. Add to this the December data, and we get a near-record 1.9 million plunge in native-born workers in just the past 2 months!

mat200

IPCT Contributor

- Jan 17, 2017

- 16,361

- 27,464

I suspect most Democrats and not so few Republicans have no clue what comes next...

Gotta lower those interest rates ..

Thought I smelt a RAT!!!Inside The Most Ridiculous Jobs Report In Recent History

Inside The Most Ridiculous Jobs Report In Recent History | ZeroHedge

There's more: shifting from a quantitative to a qualitative assessment, reveals just how ugly the composition of "new jobs" has been. Consider this: the BLS reports that in January 2024, the US had 133.1 million full-time jobs and 27.9 million part-time jobs. Well, that's great... until you look back one year and find that in February 2023 the US had 133.2 million full-time jobs, or more than it does one year later! And yes, all the job growth since then has been in part-time jobs, which have increased by 870K since February 2023 (from 27.020 million to 27.890 million).

Here is a summary of the labor composition in the past year: all the jobs have been part-time jobs!

But wait there's even more, because just as we enter the peak of election season and political talking points will be thrown around left and right, especially in the context of the immigration crisis created intentionally by the Biden administration which is hoping to import millions of new Democratic voters (maybe the US can hold the presidential election in Honduras or Guatemala, after all it is their citizens that will be illegally casting the key votes in November), what we find is that in January, the number of native-born worker tumbled again, sliding by a massive 560K to just 129.807 million. Add to this the December data, and we get a near-record 1.9 million plunge in native-born workers in just the past 2 months!

When just one job isn't enough: Why are a growing number of Americans taking on multiple gigs?

The number of Americans holding multiple jobs has reached its highest level since the pandemic's start. Inflation, remote work may be factors.

www.usatoday.com

We used to just call it "buying votes"...

"Tax Relief Act" Exposed: Something Ominous Lurks Inside...

"Tax Relief Act" Exposed: Something Ominous Lurks Inside... | ZeroHedge

A recent article published on The Daily Signal revealed that legislation claiming to provide tax relief for the middle class doesn’t quite do what it says it will:

"Tax Relief Act" Exposed: Something Ominous Lurks Inside...

"Tax Relief Act" Exposed: Something Ominous Lurks Inside... | ZeroHedge

A recent article published on The Daily Signal revealed that legislation claiming to provide tax relief for the middle class doesn’t quite do what it says it will:

Here’s exactly what this “Tax Relief” entails for those of us trying to plan for our taxes:checking inside this Trojan horse known as The Tax Relief for American Families and Workers Act instead reveals a mixed bag that includes welfare expansions, corporate windfalls, and inflationary deficits.

The only individual tax cut in the bill is a slight cost-of-living adjustment to the child tax credit – likely from $2,000 to $2,100 – that would apply to taxpayers’ 2025 and 2026 tax filings before expiring.

The bulk – 91.5% to be exact – of what is being described as “middle-class tax relief” is, in fact, an expansion of welfare benefits.

The Great Growth Hoax

The Great Growth Hoax | ZeroHedge

We Don’t Need More GDP Reports Like These

When the latest report came out and everyone cheered, I dug around the data a bit but figured I would wait for my favorite analysts to weigh in. Sure enough, Peter St Onge writes it up and it is a doozy:

Fresh GDP numbers came in and it was a blowout. The kind of blowout that only a $2.7 trillion government deficit can buy while the private economy crumbles around it. Another couple blowout GDP reports like this and Americans will be living under an overpass.

The essential ruse comes down to unfathomable amounts of government spending that is being recorded as productivity and output, and interpreted by the media as growth:

In the past 12 months the federal deficit increased by $1.3 trillion. Yet we only got half that in GDP — about $600 billion. In other words, everything else shrank. It’s even worse for that brave and stunning Q4 — there we got just $300 billion in extra GDP for — wait for it — $834 billion of new federal debt.

To put a fine point on it:

Essentially, [GDP is measuring] the pace at which we’re going Soviet, replacing private wealth with government waste.

It Costs $2.50 to Generate $1

In his interpretation of the data, we are destroying wealth at the fastest rate since 2008. An analysis by Zero Hedge echoes the same thought:

While Q4 GDP rose by $329 billion to $27.939 trillion, a respectable if made-up number, what is much more disturbing is that over the same time period, the U.S. budget deficit rose by more than 50%, or $510 billion. And the cherry on top: The increase in public U.S. debt in the same three-month period was a stunning $834 billion, or 154% more than the increase in GDP. In other words, it now takes $1.55 in budget deficit to generate $1 of growth… and it takes over $2.50 in new debt to generate $1 of GDP growth!

To further the analysis, and doing the math:

Every dollar in GDP growth cost $1.69 in new debt, and also means that every new job cost future generations of Americans $957,100.48.

To say this is unsustainable is more than obvious. It is a disaster and this is dragging American prosperity into the pits, if by prosperity you mean quality of life. No matter how many gizmos to which you have access, the resources for living a good life are depleting very fast.

The Great Growth Hoax | ZeroHedge

We Don’t Need More GDP Reports Like These

When the latest report came out and everyone cheered, I dug around the data a bit but figured I would wait for my favorite analysts to weigh in. Sure enough, Peter St Onge writes it up and it is a doozy:

Fresh GDP numbers came in and it was a blowout. The kind of blowout that only a $2.7 trillion government deficit can buy while the private economy crumbles around it. Another couple blowout GDP reports like this and Americans will be living under an overpass.

The essential ruse comes down to unfathomable amounts of government spending that is being recorded as productivity and output, and interpreted by the media as growth:

In the past 12 months the federal deficit increased by $1.3 trillion. Yet we only got half that in GDP — about $600 billion. In other words, everything else shrank. It’s even worse for that brave and stunning Q4 — there we got just $300 billion in extra GDP for — wait for it — $834 billion of new federal debt.

To put a fine point on it:

Essentially, [GDP is measuring] the pace at which we’re going Soviet, replacing private wealth with government waste.

It Costs $2.50 to Generate $1

In his interpretation of the data, we are destroying wealth at the fastest rate since 2008. An analysis by Zero Hedge echoes the same thought:

While Q4 GDP rose by $329 billion to $27.939 trillion, a respectable if made-up number, what is much more disturbing is that over the same time period, the U.S. budget deficit rose by more than 50%, or $510 billion. And the cherry on top: The increase in public U.S. debt in the same three-month period was a stunning $834 billion, or 154% more than the increase in GDP. In other words, it now takes $1.55 in budget deficit to generate $1 of growth… and it takes over $2.50 in new debt to generate $1 of GDP growth!

To further the analysis, and doing the math:

Every dollar in GDP growth cost $1.69 in new debt, and also means that every new job cost future generations of Americans $957,100.48.

To say this is unsustainable is more than obvious. It is a disaster and this is dragging American prosperity into the pits, if by prosperity you mean quality of life. No matter how many gizmos to which you have access, the resources for living a good life are depleting very fast.

mat200

IPCT Contributor

- Jan 17, 2017

- 16,361

- 27,464

The Great Growth Hoax

The Great Growth Hoax | ZeroHedge

We Don’t Need More GDP Reports Like These

When the latest report came out and everyone cheered, I dug around the data a bit but figured I would wait for my favorite analysts to weigh in. Sure enough, Peter St Onge writes it up and it is a doozy:

Fresh GDP numbers came in and it was a blowout. The kind of blowout that only a $2.7 trillion government deficit can buy while the private economy crumbles around it. Another couple blowout GDP reports like this and Americans will be living under an overpass.

The essential ruse comes down to unfathomable amounts of government spending that is being recorded as productivity and output, and interpreted by the media as growth:

In the past 12 months the federal deficit increased by $1.3 trillion. Yet we only got half that in GDP — about $600 billion. In other words, everything else shrank. It’s even worse for that brave and stunning Q4 — there we got just $300 billion in extra GDP for — wait for it — $834 billion of new federal debt.

To put a fine point on it:

Essentially, [GDP is measuring] the pace at which we’re going Soviet, replacing private wealth with government waste.

It Costs $2.50 to Generate $1

In his interpretation of the data, we are destroying wealth at the fastest rate since 2008. An analysis by Zero Hedge echoes the same thought:

While Q4 GDP rose by $329 billion to $27.939 trillion, a respectable if made-up number, what is much more disturbing is that over the same time period, the U.S. budget deficit rose by more than 50%, or $510 billion. And the cherry on top: The increase in public U.S. debt in the same three-month period was a stunning $834 billion, or 154% more than the increase in GDP. In other words, it now takes $1.55 in budget deficit to generate $1 of growth… and it takes over $2.50 in new debt to generate $1 of GDP growth!

To further the analysis, and doing the math:

Every dollar in GDP growth cost $1.69 in new debt, and also means that every new job cost future generations of Americans $957,100.48.

To say this is unsustainable is more than obvious. It is a disaster and this is dragging American prosperity into the pits, if by prosperity you mean quality of life. No matter how many gizmos to which you have access, the resources for living a good life are depleting very fast.

"It Costs $2.50 to Generate $1"

see ... we can generate a soft landing .. just need to stimulate more ..

Exactly!

Hear me out…

Stimulus = issuing money we don’t have going further into the debt spiral in order to provide free shit to the terminally stupid in return for their vote while masking the reality in language they don’t understand.

I think the primary answer to most of our current problems are the deliberate twisting/obfuscation of language which goes to its roots in education.

Imagine if we still called “stimulus” what it really is.

We see the same throughout government, especially in the names of laws passed. It’s become almost common.

Example

Inflation Reduction Act

Does nothing of the sort and much of it goes to the bogus “climate change” agenda

Would the average idiot know that from the language used? Of course not.

Hear me out…

Stimulus = issuing money we don’t have going further into the debt spiral in order to provide free shit to the terminally stupid in return for their vote while masking the reality in language they don’t understand.

I think the primary answer to most of our current problems are the deliberate twisting/obfuscation of language which goes to its roots in education.

Imagine if we still called “stimulus” what it really is.

We see the same throughout government, especially in the names of laws passed. It’s become almost common.

Example

Inflation Reduction Act

Does nothing of the sort and much of it goes to the bogus “climate change” agenda

Would the average idiot know that from the language used? Of course not.

This is the root. They can barely spell their name and aren’t even sure if they’re male or female. Using language they can’t comprehend makes it quite easy to baffle them into agreement, and giving them free shit keeps them on the reservation.

tigerwillow1

Known around here

Here's another new scheme to enrich the wall street types. I wonder how much in kickbacks the sponsor is getting?

401Kids Account: Wyden introduces bill to create savings accounts for every child nationwide

It claims that every dollar "invested", society would get $2.61 in benefits. Wonder which end they pulled that out of?

401Kids Account: Wyden introduces bill to create savings accounts for every child nationwide

It claims that every dollar "invested", society would get $2.61 in benefits. Wonder which end they pulled that out of?

Here's another new scheme to enrich the wall street types. I wonder how much in kickbacks the sponsor is getting?

401Kids Account: Wyden introduces bill to create savings accounts for every child nationwide

It claims that every dollar "invested", society would get $2.61 in benefits. Wonder which end they pulled that out of?

While all families could contribute up to $2,500 per year to the accounts, only lower- and moderate-income families would receive direct federal support.

Just another convenient way to buy votes(ers)

mat200

IPCT Contributor

- Jan 17, 2017

- 16,361

- 27,464

Here's another new scheme to enrich the wall street types. I wonder how much in kickbacks the sponsor is getting?

401Kids Account: Wyden introduces bill to create savings accounts for every child nationwide

It claims that every dollar "invested", society would get $2.61 in benefits. Wonder which end they pulled that out of?

Gotta pump up the stock market more .. retirees will be putting their funds in less risky vehicles ..

We went to our yearly visit with our Financial Advisor yesterday. He kept saying ya'll don't have anything in stocks, as he does every year. When he compared years he saw we have had a steady investment income, no losses, and actually was on the same pace as those in the stock market. He is younger and has always pushed the market. He was also amazed how we can live so cheaply, haha, he said we have one of the lowest monthly income/expenses he has seen. It is called wisely spending/buying within your means, something the younger generation has no clue about. They buy on impulse...

I expected a stock market downturn and recession by 2023, moved to more conservative investments, waiting to jump partially back in. I think they are trying to push it off till after the election from some reason!

tigerwillow1

Known around here

In my old age I'm just tired of the stress of watching the stuff go up and down with herd mentality, manipulation, and emotion instead of any hint of logic. The I-bonds from the late 90s and early 00s with a 3+% base rate have been our best long term investments, and stress-free.He kept saying ya'll don't have anything in stocks, as he does every year.

yeah, they are hiding the true economy with BS made up numbers out of BLS and GDP games along with massive deficit spending.

Unless we get a banking crisis they'll keep the false data coming and hold off the downturn until after the election...if we have one

IF we dont have a banking crisis...

New York Community Bancorp Cut To 'Junk' By Moody's: 33% Of Deposits Uninsured

New York Community Bancorp Cut To 'Junk' By Moody's: 33% Of Deposits Uninsured | ZeroHedge

New York Community Bancorp Collapse Nears 27-Year-Lows After 'Talks With Regulator' Revealed | ZeroHedge

Bank Blow-Up 'Butterflies' Spark Bid For Bonds, Bullion, & Bitcoin | ZeroHedge

Unless we get a banking crisis they'll keep the false data coming and hold off the downturn until after the election...if we have one

IF we dont have a banking crisis...

New York Community Bancorp Cut To 'Junk' By Moody's: 33% Of Deposits Uninsured

New York Community Bancorp Cut To 'Junk' By Moody's: 33% Of Deposits Uninsured | ZeroHedge

New York Community Bancorp Collapse Nears 27-Year-Lows After 'Talks With Regulator' Revealed | ZeroHedge

Bank Blow-Up 'Butterflies' Spark Bid For Bonds, Bullion, & Bitcoin | ZeroHedge

Sybertiger

Known around here

Not sure what bonds are doing but for those who want FDIC backing, interest at 4.35% and full liquidity:

www.discover.com

www.discover.com

High Yield Savings Account - No Monthly Fees | Discover

Open a high interest savings account that offers high yield interest rates with no monthly balance requirements or monthly fees.